Forms Center; For your convenience, we've gathered together some of the most frequently used forms. 10034 ICICI Bank Mumbai-400 044. Account registration for ECS: Download: Increasing offer amount of Credit Card: Download: Transaction charge back for disputed transactions: Download: Account closure due to customer’s. If you want to close your ICICI bank account then make sure that you have withdrawn all your balance amount from your bank account. Next you need to visit your ICICI branch and there you can get an account closure form of ICICI bank. Sometimes the bank staff may ask you to write a letter to close your bank account. My honest suggestion: Don't move to Zerodha. Whatever you save in brokerage, you'll lose twice or even thrice that because of stupid mistakes by the morons running Zerodha. UPI: rajchetri@axisbank For Any Query, Follow & Message Us: Use Free Background Music: http://bit.ly/usefreemusic. ICICI Bank Personal Loan Preclosure Statement Terms and Conditions. You can close your ICICI personal loan account in advance if you agree to the following conditions put forward by the bank: ICICI Bank issues personal loan Foreclosure Statement only after 180 days (6 months) from the date of loan disbursement.

Close Bank Account in ICICI Bank: This one is considered as one of the best bank operating in India. In case you don’t want to use your account any more because of any reason, there are number of reasons why you want to close the account you can do that. And if you are planning to close your account because it has turned dormant overtime as you have not used it from long time then I have other way for you. I have published a guide which will tell you how to reactivate Dormant account in ICICI Bank. But if you have made up your decision to close it they this guide will help you to do so.

We have Recently Published:

- How to Open Fixed Deposit in ICICI Bank.

- And How to Open Current Account in ICICI Bank.

Contents

- How to Close Bank Account in ICICI Bank?

How to Close Bank Account in ICICI Bank?

So now let us get started with this guide and check out the procedure which you need to follow to close account in ICICI Bank. I have listed down all the steps below in brief.

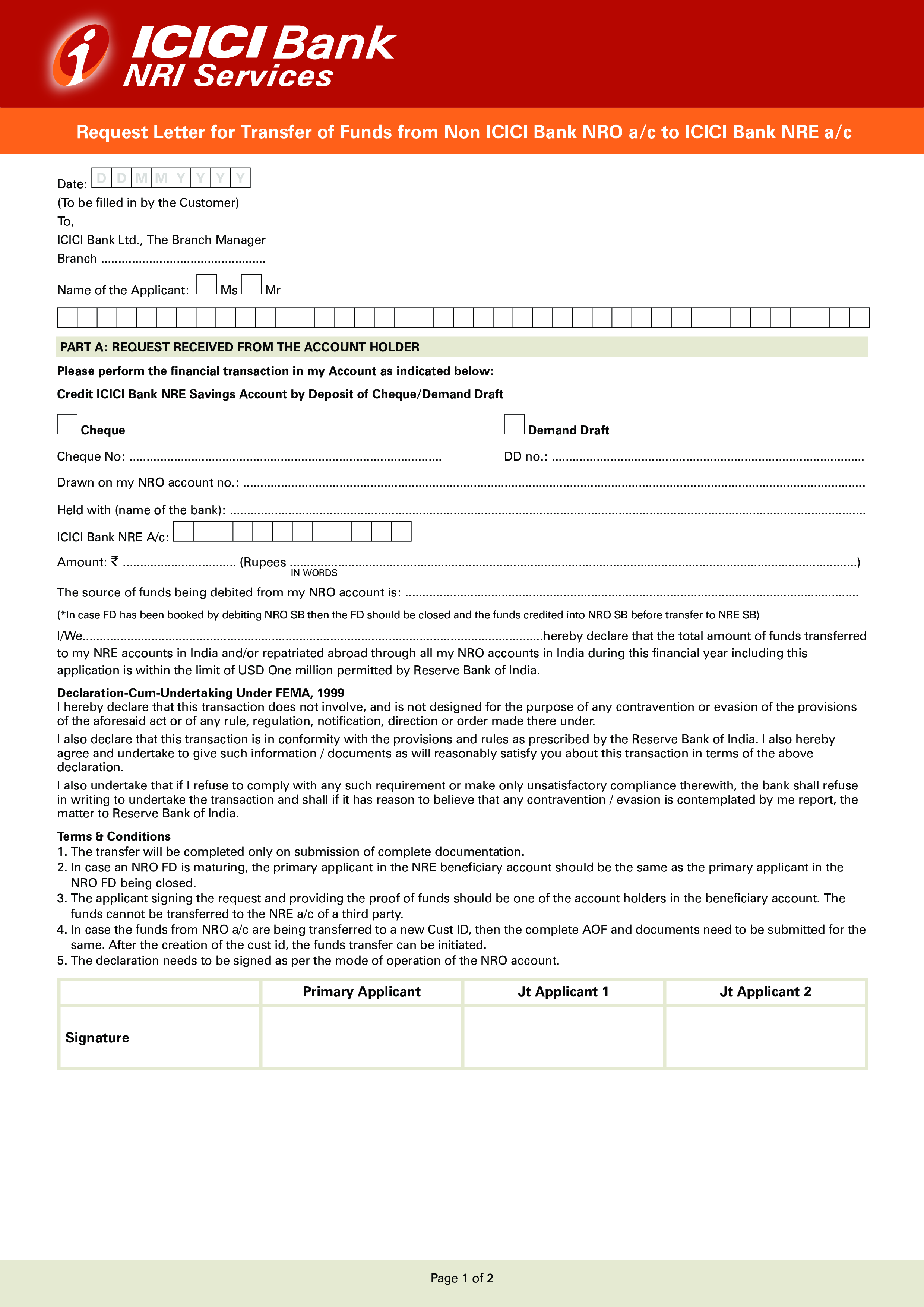

- Collecting and filling up Account Closure from.

- Returning your Passbook, Debit Card, Credit Card, Cheque book.

- Submitting address proof and identity proof documents to the bank.

Procedure to close bank account in ICICI Bank:

- The first thing you need to do is visiting your branch and ask for an account closure form which is available to you from any of the branch.

- Fill that form with all the details which is asked to you in the form, and recheck the for to make sure you have filled everything correctly.

- You will be asked to fill in various details like Account Number, your name, registered mobile number and mainly your signature.

- You have to choose a method by which you are willing to receive the balance amount which is remaining in your account. The methods which are basically available are Cash, Cheque, Demand Draft and Balance transfer to other account.

- Now you have completed your task to fill the form with all the details which is asked in the form and have chosen the method to receive you balance amount as well.

- You have to submit few of the document to the officials and they are Address Proof and Identity proof documents.

- If you want to know about the documents required by ICICI Bank you can refer this linked article. In this liked article you will find all the address proof and identity proof documents which are accepted by them.

- Take the photocopies of the documents which you want to submit and make your signature on them to make them self attested. Because without your signature on them, those photocopies are not considered as valid ones.

- Submit account closure form along with your documents to the branch manager and you are done with it, you have successfully closed your account. You will receive the balance which is remaining in your account.

Final Words.

So this was all about how you can close bank account in ICICI Bank, I hope you are clear with all the steps which I have mentioned in this guide. If you have any kind of doubts you can comment below, I will respond to your comment as quick as possible.

- Products

- High Interest Investment Savings Account

- Term Deposits

- Other Segments

- Other ICICI Bank Website

- ICICI Bank Country Websites

After the account has been opened, when will we receive the Term Deposit / RSP / GIC confirmations?

Icici Bank Forms Download

Fifteen business days is the standard time. Salman khan wanted full movie download mp4. However, ICICI Bank Canada reserves the right to extend this depending upon market and business factors.

Is a Term Deposit the same as a GIC?

Yes it is. ICICI Bank Canada has registered the name Term Deposit for our GIC product with CDIC.

With regard to joint ownership GICs, are they registered as 'or', 'and/or', or 'and'?

Does ICICI Bank issue a certificate for a joint investment as 'and' upon a client's request?

No. ICICI Bank Canada opens all joint accounts as “and/or” only.

How closely must the pre-printed names on the client’s personal cheque match the investment registration?

The name should be the same as the account holder’s name. We will contact you for clarification if there is any discrepancy. Azhagu raja full movie download hd.

Does a Joint bank account cheque signed by both act as Identification for both owners on a GIC application?

Yes. A Joint bank account cheque signed by both acts as Identification for both owners on a GIC application.

What value date is given for a non-registered GIC or savings account?

Either a) date of postage of cheque, marked on the envelope or b) if deposit made by EFT, date of credit in account or c) date of credit in NDDS account with RBC. Note that a photocopy of the stamped deposit slip must be sent to us along with the name of the client.

Icici Bank Current Account Closing Form

How many days in advance will ICICI Bank forward the maturity cheques to our office and will ICICI Bank use a courier service for the same?

Cheques will be provided 2 weeks prior to maturity date. Our courier service provider is ICS.

How will the Bank send out transfer cheques to other institutions?

ICICI Bank will send out transfers through our contracted courier service, ICS.

Do we need to request the maturity cheques or will ICICI Bank forward them to us automatically?

The maturity cheques shall be sent to the Financial Representative, for clients sourced by them, unless the client explicitly mentions not to send the maturity cheques to the Financial Representative.

Will ICICI Bank require their certificates/confirmations back at maturity for redemption?

Only if a client walks into a branch to withdraw the deposit.

How will the Bank handle an investment that matures on a weekend or holiday?

ICICI Bank will automatically roll over the maturity date to the next business day.

Do we need to retain client information at our office?

Yes. A record of all client information needs to be maintained by the FR at their office. The information includes:

Icici Bank Account Closing Letter Format

| What you need to retain at your office | |

|---|---|

| Please retain a copy of 2 pieces of identification (ID) for each individual (Photocopied front & back to clearly identify the individual’s signature), ensuring that at least one piece is from List A below: | |

Primary Identification (List A) | Secondary Identification (List B) |

|

|